Explain the Journal Entry Method of Recording End-of-period Adjustments

The appropriate end-of-period adjusting entry establishes the Prepaid Expense account with a debit for the amount relating to future periods. The Trading ac Profit Loss ac and the Balance Sheet.

Adjusting Entries Guide To Making Adjusting Journal Entries Examples

The adjustments are made at the time of making up the final accounts within the three parts that make up the final accounting ie.

. What is an adjusting journal entry. Companies typically adjust journal entries as part of the end-of-period accounting process. To understand adjusting entries better lets check out an example.

These adjustments are necessary to make final entries for the year and ensure that the companys financial statements are accurate and complete. What are Prior Period Adjustments. Explain the journal entry method of recording end of period adjustments 1.

Best Car Battery Brand Philippines. An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. Prior period adjustments are adjustments made to periods that are not a current period but already accounted for because there are a lot of metrics where accounting uses approximation.

The periodic inventory system journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting under a periodic inventory system. End-of-period-adjustments in accounting Background to end-of-period-adjustments in accounting. This can encompass monthly quarterly or half-year statements.

The following practice questions offer some useful examples of journal entry adjustments. The ending inventory is determined at the end of the period by a physical count and subtracted from the cost of goods available for sale to compute the cost of goods sold. By the end of this course you will be able to.

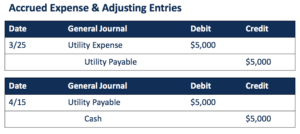

Adjusting entries fall into two broad classes. So these accounts must be updated for matching incurred expenses against the revenue of the period. Explain the Journal Entry Method of Recording End-of-period Adjustments Accountants record these journal entries in the general ledger accounts and usually prepare them at the end of the fina Read more.

The following Adjusting Entries examples provide an outline of the most common Adjusting Entries. Practice questions At the end of the year an. In each case the periodic inventory system journal entries show the debit and credit account together with a brief narrative.

Such expenses are recorded by making an adjusting entry at the end of accounting period. Each adjusting entry has a dual purpose. It is impossible to provide a complete set of examples that address every variation in every situation since there are hundreds of such Adjusting Entries.

However approximation might not always be an exact amount and hence they have to be adjusted often to make sure all the other principles stay intact. Explain the Journal Entry Method of Recording End-of-period Adjustments. A Debit Prepaid insurance 800.

End Entry Explain Method. Every adjusting entry involves a change in revenue or expense accounts as well as an asset or a. The most common interim period is three months or a quarter.

Demonstrate the required adjustment needed at the end of the period. Adjusting journal entries are entries in a financial journal that ensure a business allocates its income and expenses. The company immediately debited the Insurance expense account.

Accountants record these journal entries in the general ledger accounts and usually prepare them at the end of the financial year after the preparation of a trial balance. Qb assigns journal entry numbers for reference 2. Using Quickbooks Accountant 2014 13th Edition Edit edition Solutions for Chapter 9 Problem 1Q.

Thus every adjusting entry affects at least one income statement account and one balance sheet account. The offsetting credit reduces the expense to an amount equal to the amount consumed during the period. Solutions for problems in chapter 9.

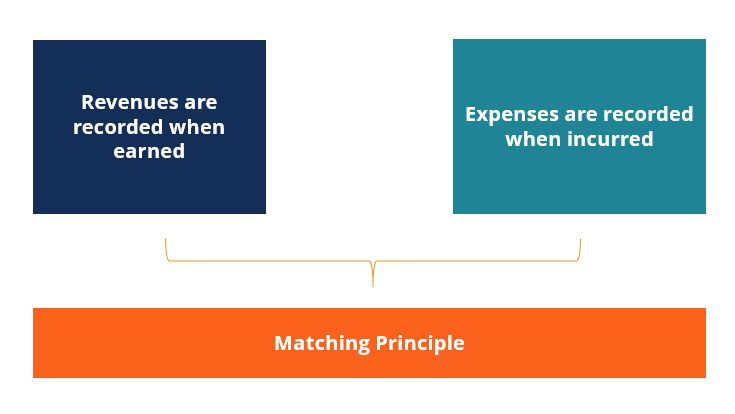

End-of-period adjustments are also known as year-end-adjustments adjusting-journal-entries and balance-day-adjustments. Unpaid expenses are expenses which are incurred but no cash payment is made during the period. End-of-period-adjustments apply the matching principle of accounting which include accruals deferrals and asset value adjustments.

1 to make the income statement report the proper revenue or expense and 2 to make the balance sheet report the proper asset or liability. At the end of the period the total in purchases account is added to the beginning balance of the inventory to compute cost of goods available for sale. By the end of the period 400 of the policy had expired.

Adjusting entries also known as adjusting journal entries Adjusting Journal Entries Adjusting Entries in Journal is a journal. Determine what current balance should be. By Ra_Eliana14 23 Apr 2022 Post a Comment Accountants record these journal entries in the general ledger accounts and usually prepare them at the end of the fina Battery Brand Car wallpaper.

Here are the three main steps to record an adjusting journal entry. But at the end of the fiscal year some of the accounts are recorded without any changing. Recording AJEs is quite simple.

It updates previously recorded journal entries so that the financial statements at the end of the year are accurate and up-to-date. Determine current account balance. The information contained on these statements is timelier than waiting for a yearly accounting period to end.

Adjusting entries for accruing unpaid expenses. Battery Brand Car wallpaper. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step.

The general formula to compute cost of. One of the steps in an accounting cycle is the process called adjusting entries. -Define accounting and the concepts of accounting measurement -Explain the role of a bookkeeper and common bookkeeping tasks and responsibilities -Summarize the double entry accounting method -Explain the ethical and social responsibilities of bookkeepers in ensuring the integrity of financial.

Accounting of Adjusting Journal Entries. Uses the alternative method of accounting for prepayments and purchased a 1200 6-month insurance policy. Journal number used for end-to-date transaction may follow journal entries used for April business events hence the date specified in journal is important.

According to matching principle the expense must be matched against recognized revenue. Explain the journal entry method of recording end-of-period adjustments. An interim period is any reporting period shorter than a full year fiscal or calendar.

You typically enter these at the end of a fiscal period to ensure that any income you earn or expenses you incur reflect the fiscal period in which they occurred. If we know the Journal entry we can identify the effect of the same on the ledger accounts and thus be able to identify the adjustments to be made.

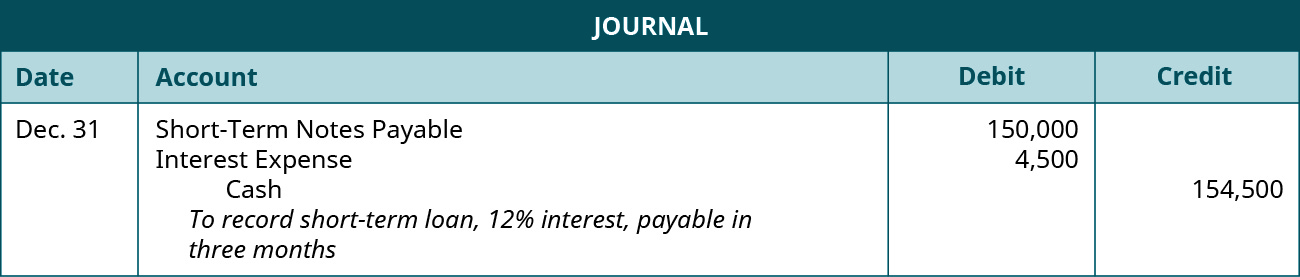

Prepare Journal Entries To Record Short Term Notes Payable Principles Of Accounting Volume 1 Financial Accounting

Bookkeeping Vs Acc Accounting Process Accounting Basics Bookkeeping Business

Comments

Post a Comment